Donor advised funds

If you have a donor advised fund (DAF), consider contacting your fund manager and recommending a grant to the Sewell C. Biggs Trust, dba Biggs Museum of American Art. Your manager will send a check directly to The Biggs from your fund.

Gifts of stock

Giving appreciated stock that was purchased more than a year ago directly to The Biggs lets you avoid paying up to 20% in capital gains taxes on these earnings. Consider this tax advantage and make a stock gift to the Sewell C. Biggs Trust, dba Biggs Museum of American Art. Give your stockbroker this information:

Registration/Account Name:

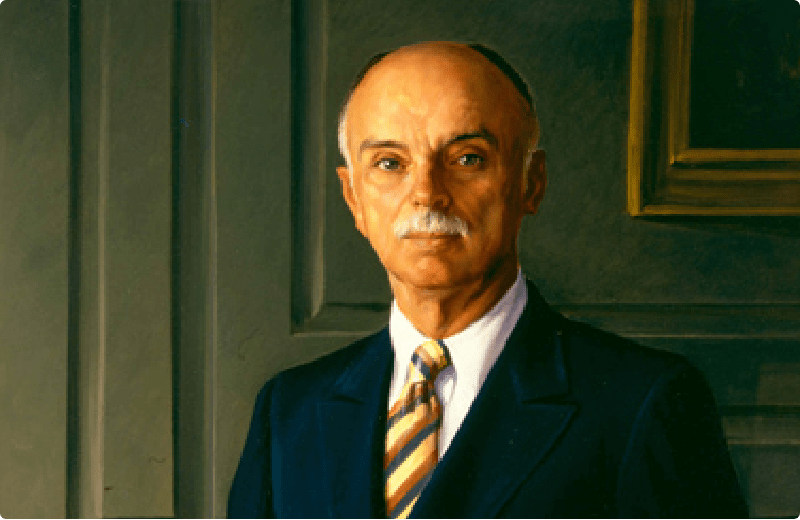

Sewell C. Biggs Trust

EIN Number: 51-6171556

Account #: 14135640

DTC #: 0062

Donating through your IRA

If you are older than 70½, give from your IRA as a tax-free distribution to the Sewell C. Biggs Trust dba Biggs Museum of American Art. Any amount, up to $100,000 annually, distributed from your IRA directly to The Biggs will count toward your required minimum distribution without being considered taxable income, lowering your adjusted gross income.

Corporate Matches

Does your company match contributions to nonprofits?

Take advantage of this easy way to increase the impact of your philanthropic dollars. Tell your company that you support The Biggs.

For more information on these options, contact our development department:

302.760.5302 or sandra.james@

The material presented on this site is not offered as legal or tax advice. For your

situation, consult your attorney, tax adviser, financial adviser or other professional.